The Big Difference Between European And American Beauty Deals

Venture capital and private equity firms’ relationship with beauty is deeper in the United States than it is in Europe, while the European beauty market is characterized by more later-stage activity.

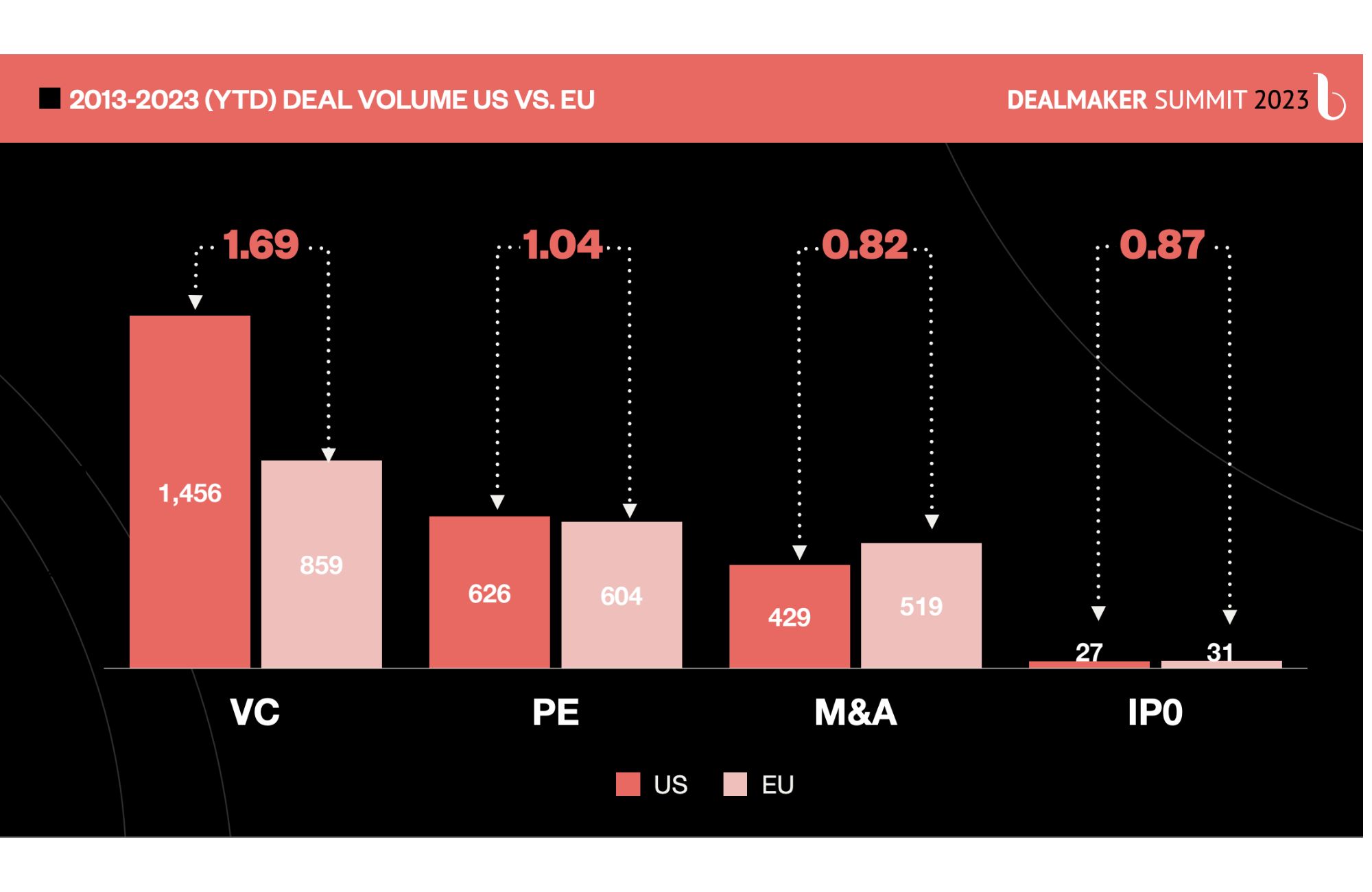

In the last decade, American beauty and wellness brands have racked up 60% more venture capital deals than their European counterparts, according to data provided by investment bank Raymond James. Specifically, there’s been nearly 1,500 VC deals in beauty and wellness from 2013 to 2023 in the U.S. compared to almost 860 in Europe. On the private equity front, there’s been approximately 626 deals in the U.S. and 604 in Europe.

Later-stage deals tell a different story. Companies bought European beauty and wellness brands 519 times over the last decade versus 429 times for American beauty and wellness brands. Meanwhile, initial public offerings stood at 31 for European beauty and wellness companies and 27 for American beauty and wellness companies.

“European founders are probably slightly more cautious than U.S. counterparts in our fundraising approach,” said Emily Bullman, an investor at consumer fund JamJar Investments. “But there are still deals being done by those who are committed to investing in verticals like beauty, which we see as a recessionary-proof industry.” Beauty and wellness brands make up 40% of JamJar’s portfolio. The portfolio contains natural deodorant brand Wild, clinical line Skin + Me, electric toothbrush brand Suri and K-beauty brand Yepoda.

Bullman was joined by Dominic Hawksley, founder and managing director of upscale bath brand Olverum, and Badria Ahmed, founder of haircare brand Holy Curls, for a panel on funding during Beauty Independent’s Dealmaker EU/UK Summit this month. Hawksley diagnosed American investors as having a greater appetite for risk and placing a premium on rapid growth.

“The mindset in the States I think is very much iterating fast, failing fast, embracing what the possible is rather than focusing on what could possibly go wrong,” he said, pointing out that Brexit has added layers of complexity to running a business in continental Europe. “It’s much harder to scale a brand through Europe now, especially after Brexit. Language, regulatory, taxation, all these sort of things come into play.”

Since Hawksley acquired Olverum in 2014, when it had a single product, the brand has been bootstrapped. It’s taken a measured approach to expansion and is available at Liberty, Space NK and John Lewis. Its hero bath oil retails for $110 and contains essential oils abies sibirica, eucalyptus, rosemary and lavandin.

Fragmentation in the European retail channel impacts the investment landscape in the region. Brands tend not to require large infusions of capital at the outset as large-scale wholesale opportunities are less prevalent. Although Sephora and Space NK operate in the U.K., their U.K. footprints aren’t as extensive as Sephora and Ulta Beauty’s footprints in the U.S., where Target and Walmart are huge retail players, too.

Wholesale wasn’t on Holy Curls’ initial roadmap for its early years, but retailers approached the brand to take it on. Shortly after it launched in the U.K., it journeyed to the U.S. with a 2020 debut at The Detox Market. Outside of The Detox Market, it’s in Bluemercury, Violet Grey and in J.C. Penney through its partnership with Thirteen Lune. The brand required cash support its rollout to 622 doors between J.C. Penney and Bluemercury.

U.K.-based VC firm Piper reached out to Ahmed following a Holy Curls press hit, but ultimately deemed the brand too small for it. However, five of Piper’s investors became angel investors in the brand to enable it to cover inventory for its stockists. Wholesale currently accounts for 50% of Holy Curls’ sales. Its haircare products include $45 Oil Serum, $34 Shampoo, $32 Conditioner, $34 Cream and $29 Gel.

Bullman encourages European brands to nail their home market before traveling abroad. “There is a temptation for brands to quickly go to the U.S. because it’s a massive market, but to do the U.S. successfully, you have to be really considered about your approach. You need to have a ton of capital and experience behind you to effectively capitalize on that opportunity.”

Olverum expects to pursue series A funding in 2024 to support retail growth in Europe and the U.S. “We’ve grown the range because we realized that some retailers like John Lewis, for example, they can’t sell just one product,” said Hawksley, mentioning that Olverum is the top seller in the body care category at John Lewis. “We know that there’s an appetite beyond these shores, there is great opportunity in the U.S., but all of these require building inventory to support that expansion and also help with digital marketing.”

Ahmed noted that taking on capital can be scary for founders due to the chance that they could lose control over their brand and the growth pressures that an investor may bring. Before having a partnership with investors, she wasn’t sure what they would entail. Bullman said part of her job is to instruct founders “it’s OK to take the funding if you get it from the right type of investors who are super committed.” At the moment, she explained that investors, no matter if they’re in Europe or the U.S., are interested in brands that are optimizing profits rather than growth, a factor that could help quell founder fears about chasing growth.

Bullman said Jamjar aims for at least a 10X return on its investments. Its typical seed check sizes range from $500,000 to $3.5 million, but it’s also involved in follow-on rounds. Bullman spelled out that JamJar zeroes in on people, products and potential when vetting investments. She said, “Are they an amazing team that has some experience and is super ambitious? Is it a product that people genuinely love? Are they taking time to look at the market and competitive dynamics, and can we get to a $250 million exit value?”

Bullman emphasized, “We’re not just cash cows. We’re here to be a long-term partner in your business and support you in how you just grow that little bit faster.”

Click here to secure early bird tickets to Dealmaker New York happening June 17-18, 2024.

Leave a Reply

You must be logged in to post a comment.