Spate: 15 Indie Beauty Brands Leading In Sustained Search Volume Growth

It’s great to suddenly go viral on TikTok, but it’s even better to have sustained momentum over time.

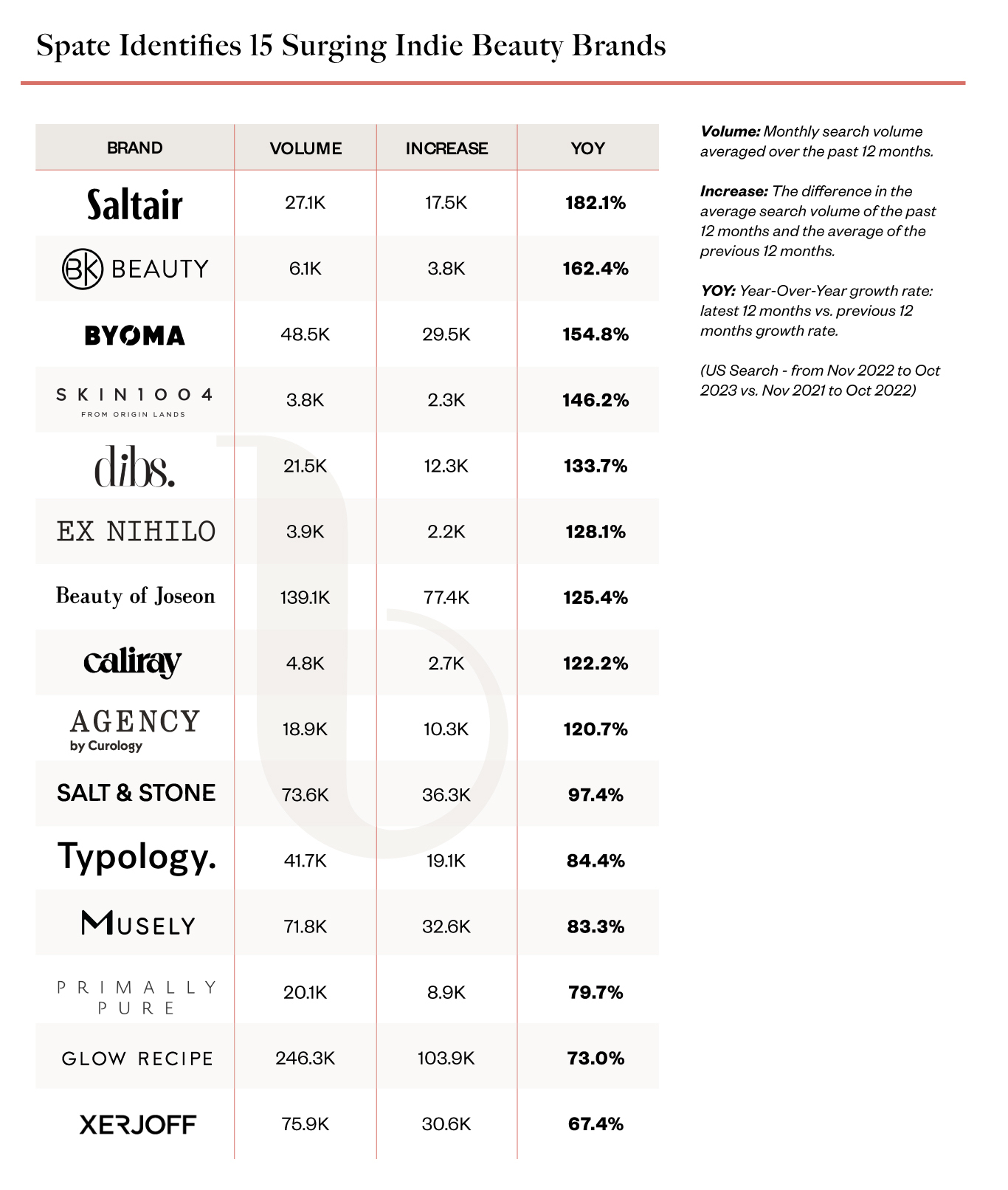

To pinpoint drivers of prolonged growth in consumer awareness, we turned to machine intelligence beauty platform Spate to identify 15 indie beauty brands that have been leaders in drawing increased search volume in the United States from November 2022 to October 2023 versus the year-ago period. In this effort, Spate took a broad view of indie beauty brands as brands not owned by major beauty conglomerates.

The results illustrate that beauty consumers are hunting for skincare and drilling down into niches within it. Whether it’s body care (Salt & Stone, Saltair and Primally Pure represent the subcategory in Spate’s data), teledermatology (Musely and Agency) or K-Beauty (Glow Recipe, SKIN1004 and Beauty of Joseon), they’re actively seeking brands known to be authorities in specific areas.

While TikTok and influencers play a role in the upward trajectory of the brands on Spate’s list of surging indie beauty brands (see TikTok-favorite BK Beauty and influencer Courtney Shields-founded DIBS Beauty), it provides evidence that it takes more than social media fame to move the needle for a significant stretch. Below, Olivier Zimmer, co-founder and CEO of Spate, tells us more about the categories and brands beauty consumers are seeking out online.

Teledermatology

“Agency and Musely are two high-growth brands with the goal of providing clients with accessible, effective treatments through teledermatology. Consumers search for Agency before-and-afters along with Reddit threads on the topic.

They also look to Agency for tretinoin prescriptions. Musely is searched especially for its spot cream, which comes in a number of formulas to target hyperpigmentation for different skin types. The rise in these two brands speaks to growing interest in clinical solutions that are easy to get from the comfort of consumers’ homes.”

Body care

“Body care brands like Saltair, Salt & Stone and Primally Pure are bringing unique experiences to the body care category. Saltair offers everything from body wash to body oil, though they’ve recently expanded into the haircare category as well.

Consumers are currently only searching Saltair, however, indicating exposure to the brand in other platforms and media. They’re taking to Google to explore its offerings. Salt & Stone and Primally Pure take a more clean beauty approach.

Salt & Stone, searched especially for its deodorant and body wash, promotes its closeness to nature through functional fragrance and ingredients. Primally Pure is another brand searched for its deodorant in particular, and their product messaging emphasizes the importance of minimal, clean ingredients.

Other body care brands should monitor the success of these brands and consider their opportunities accordingly. Whether that means diversifying into another category—i.e., hair à la Saltair—or creating a clean-marketed deodorant like Salt & Stone and Primally Pure, there’s a fresh angle for every player.”

K-Beauty

“K-Beauty serves as a constant source of inspiration for the U.S. beauty market. This point is made more evident by the inclusion of three Korean skincare brands in this list: SKIN1004 and Beauty of Joseon. SKIN1004 receives significant attention for its Madagascar Centella Ampoule and Zombie Pack—a popular pore-tightening treatment that gives the appearance of cracking skin while in use—showing a reciprocal relationship between soothing and treating.

Beauty of Joseon’s viral Relief Sun : Rice + Probiotics sunscreen is the top-searched product for the brand, indicating the importance of a strong community of online advocates for international brands seeking to expand into new markets. Across the U.S. market, opportunities for Korean brands continue to grow and K-Beauty brands that don’t already have a broad distribution network should consider implementing one.”